Vietnam is a very open country from a foreign investments point of view. Foreign companies interested in establishing a presence here through a branch office can receive specialized assistance form our local incorporation agents.

Our Vietnam company formation specialists can provide you with step-by-step guidance regarding how to open a branch in Vietnam.

| Quick Facts | |

|---|---|

| Applicable legislation |

Foreign country |

|

Best Used For |

Banking and finances |

|

Minimum share capital |

No |

| Time frame for the incorporation |

Appox. 12 weeks |

| Management | Local |

| Legal representative required | Yes |

| Local bank account |

Yes |

| Independence from the parent company | Fully dependent on the parent company |

| Liability of the parent company | Full liability for the branch office’s obligations |

| Corporate tax rate | 20% on profits earned in Vietnam |

| Possibility of hiring local staff | Yes |

| Branch office means | A branch office in a foreign country means that a company has established a physical presence in that country to conduct business activities |

|

Business licenses requirement |

A branch must obtain necessary licenses and permits to operate legally |

|

Incentives |

Preferential tax rates, which involve reduced tax rates, and tax holidays, which provide exemptions from taxation for a specific period or throughout a project. Additionally, Vietnam also offers a land rental exemption policy aimed at reducing expenses for companies operating in the country |

| Company name | The branch office must have a unique name that complies with Vietnamese regulations |

| Registered capital |

No minimum registered capital is required to set up a branch in Vietnam |

| Time frame for branch incorporation |

30-60 days |

| Legal representative assistance |

The branch office must appoint a legal representative who will be responsible for its operations. Our Vietnamese agents offer this assistance. |

| Standard VAT rate |

10% |

| Employment Laws |

Branches must adhere to Vietnamese labor laws regarding hiring, working hours, and employee benefits |

| Office space | A physical office space is required to set up a branch in Vietnam |

| Activities |

Commercial activities related to its parent company |

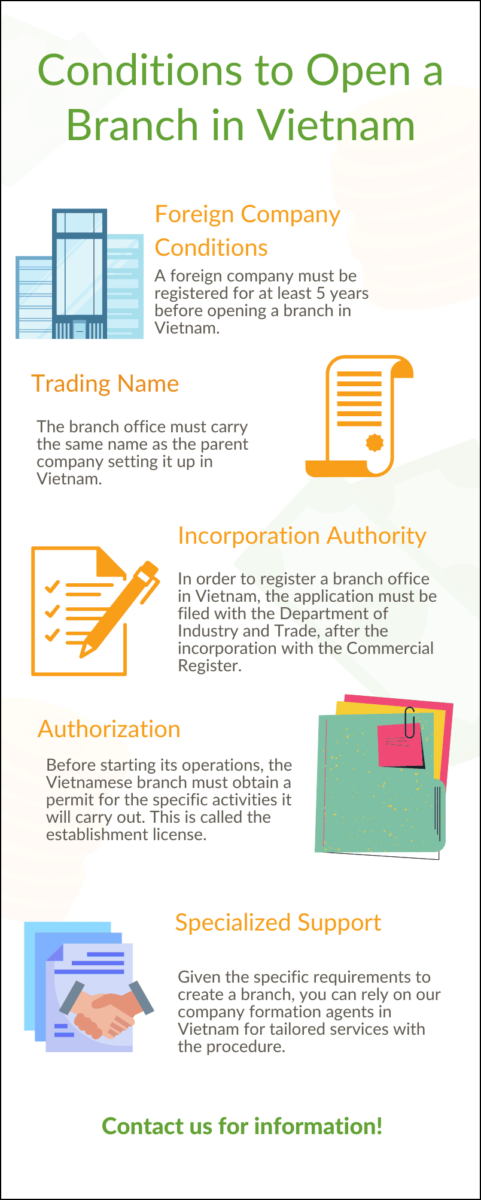

Requirements to open a branch office in Vietnam in 2024

It must be noted that the foreign company registering the branch office in Vietnam must comply with a few requirements, among which:

- it must be recognized by the directly interested authorities in its country of residence;

- it must have been trading on the local market for at least 5 years.

If you are interested to set up a branch in Vietnam in 2024, you can consult with our company incorporation consultants. They can offer you comprehensive guidance in this regard. Furthermore, if you want to explore online incorporation options in Vietnam, you are welcome to get in touch with our specialists. They will guide you about the Vietnamese company structures that you can incorporate online.

The structure of a branch office in Vietnam

The branch office will represent the foreign company on the Vietnamese market through various departments which can also be found in the parent company. The branch can have its own accounting, marketing, and human resources departments which will represent the parent company in front of the local authorities.

Here is also an infographic on the branch:

These departments must comply with the internal regulations imposed by the parent company; however, they must also respect the Vietnam laws. Businessmen interested in setting up branches in another country, for example in Ireland, can receive assistance from our partners – IrelandCompanyFormation.com.

Registering a branch office in Vietnam

Compared to other types of companies, the Vietnam branch office will be registered with the Department of Industry and Trade and not the Ministry of Planning and Investment. The branch office must have the same name as the parent company and must also have a seal bearing the same name.

In order to set up a branch in 2024, it is advisable for the foreign company to appoint a local agent who can complete the registration and licensing procedures. It is important to know that a Vietnam branch needs a special permit, called the establishment license.

Our company registration consultants in Vietnam can assist with the incorporation process of a branch office.

In addition to the incorporation of a branch office, our company formation specialists can assist you to open any type of company in this country. Get in touch with our agents to learn about different company structures and their regulations in Vietnam.

You can also watch our video on how to create a branch office in Vietnam:

Documents needed to set up a branch in Vietnam

It is crucial to submit the right documents when you apply to incorporate a branch in Vietnam. In this case, you are recommended to take assistance from experts. Our company formation agents in Vietnam can guide you in detail about the set of documents which you are required to present. They can also guide you in case you want to open a branch office in another Asian country, for example in India. Their partners from indiacompanyformation.com can help you extend your business there or even set up a new company in India. However, you can also find below general guidance about the required paperwork. The foreign company must prepare the following documents upon the registration of a Vietnam branch office in 2024:

- a notarized copy of the parent company’s certificate of incorporation issued by the Trade Register in its home country;

- a notarized copy of the parent company’s statutory documents issued by the same Trade Register;

- a notarized copy of the last audited financial documents of the parent company;

- the Vietnam minutes of the last audited financial documents of the parent company.

The documents above must be filed with the Department of Industry and Trade together with:

- a notarized copy of the rental contract for the business address of the branch;

- a notarized copy of the local branch office representative’s passport;

- the incorporation documents of the branch office in original;

- a prescribed application form issued by the Ministry of Trade.

All documents sent by the foreign company must be translated into Vietnamese. If you have any additional questions in this regard, you can interact with our experts. They can answer your concerns accordingly. Additionally, if you need any further help to trademark the services of your company, our specialists in Vietnam can also assist you in this procedure.

The manager of a branch in Vietnam

One of the requirements related to setting up a branch in this country is to appoint a branch manager who is a Vietnam resident. The branch manager will have the following responsibilities:

- will manage the day-to-day operations of the branch;

- will represent the branch in the relations with the Vietnamese authorities;

- will act as a contact point between the branch and the parent company.

The branch manager is also in charge with hiring employees for the company and must make sure that all the objectives of the branch are met.

Foreign companies can appoint a manager from their countries of origin, however, this employee must apply for a Vietnam work permit in order to be allowed to occupy this function.

Our Vietnam company registration advisors can offer information on how to apply for a work permit.

Activities that can be completed by a Vietnam branch office in 2024

Even if established by a foreign company, the branch office must comply with the requirements of the Vietnam Company Law. Under the local legislation a Vietnam branch is entitled to:

- conclude commercial contracts and other types of agreements on behalf of the parent company;

- sell and purchase goods or services on behalf of the parent company in Vietnam;

- all its activities must be conducted in accordance with the license it was issued;

- to hire Vietnamese employees or to bring employees from the parent company’s country of residence.

Our Vietnam company formation consultants can help foreign companies interested in applying for an establishment license when opening a branch office in this country.

Advantages of a branch office in Vietnam

Please find below the advantages of setting up a branch in Vietnam:

1. Attracts new clients

Getting and retaining more clients is one benefit of starting a branch in Vietnam. You can add new goods to your inventory or discover unexplored consumer markets. Opening a new business is a strategy for attracting and retaining clients. Expanding earnings can be attained by having a growing client base.

2. Decrease cost per unit

The costs of running a firm will undoubtedly decrease with business growth or the advantages of creating a branch office. There is a possibility for profit increases with each new client, but initially, there is a risk associated with growth. Operations involving manufacturing can benefit from economies of scale. More productivity is the result, which balances out lower unit costs for shipping, materials, labor, and energy.

If another branch of your firm is bringing in a lot of money and one of your locations is not performing well financially, you can still make up your losses. An economic downturn may be more severe in one branch location than in other locations. As a result, your company will continue to succeed. To learn more about such strategies, you can get in touch with our company formation experts in Vietnam.

3. Expand your market reach

Utilizing economies of scale is where corporate expansion faces the most challenge. It has the benefit of increasing production output, which lowers the cost per unit and secures savings.

- you can save money by purchasing in bulk;

- higher productivity by spreading staff or administrative expenditures;

- reducing advertising expenses with more sales.

The business expansion makes it possible to increase sales and earnings, reinvest profits, and control market prices. To rely on income streams, diversifying into new markets is beneficial.

Our experts can introduce a lengthy list of advantages of incorporating a branch in Vietnam. If you are serious about opening a branch in Vietnam, the services of our experts are at your disposal.

Restrictions imposed on branches in Vietnam

It should be noted that not all types of foreign companies are allowed to open branch offices in Vietnam. Financial companies offering accounting services are not allowed to create branches in Vietnam. Also, credit rating agencies and commodities trading platforms cannot operate under branches in Vietnam. If you are looking for the assistance of a Vietnamese accountant, get in touch with our agents. You should keep in mind that businesses must still submit a value-added tax (VAT) statement by the due date for tax declaration and payment even if they do not produce input or output invoices. It means you must need the services of an accountant, so getting help from professionals is recommended.

Why open a branch office in Vietnam in 2024?

Foreign companies setting up branch offices in Vietnam will benefit from the following:

- to lease or rent office space and equipment which help them operate in Vietnam;

- to remit the profits to their home countries based on the Vietnamese legislation;

- to offer their services or sell their goods to Vietnamese customers;

- to open local bank accounts in the Vietnamese currency or other foreign currencies;

- to purchase goods and services from local suppliers in accordance with their business license.

You can also rely on our local advisors if you are interested in setting up a company in Vietnam.

Taxation of branch offices in Vietnam

The same corporate income tax rules apply to branches of international companies as they do to businesses with Vietnamese incorporation. Please find below the CIT rates in Vietnam:

- Vietnam’s regular corporate income tax (CIT) rate is 20%, while businesses engaged in the oil and gas industry will be subject to rates ranging from 32% to 50%;

- A Vietnamese firm will be immune from taxes when it pays dividends to its corporate owners. Additionally, there will not be any withholding taxes applied to dividend payments made to foreign company shareholders;

- The withholding tax for individual shareholders will be 5%;

- Withholding taxes of 5% and 10% will be applied to royalties and interest payments made to non-residents, and corporate entities respectively.

Economic facts for 2024

Based on the assumption of a recovery in exports, Vietnam’s GDP is expected to develop by 6% in 2024, recovering from a slowdown in 2023, according to a January update from the ASEAN+3 Macroeconomic Research Office (AMRO).

Due to a slowdown in exports, the Vietnamese economy faced substantial problems last year. However, in the second half of the year, it exceeded forecasts with a growth rate of 5.1%.

Along with investment and consumption, exports were one of the three major drivers of Vietnam’s economic growth in 2023. The exports of the nation decreased in the first quarter of 2023, but they began to increase in the second quarter. Export values exceeded US$30 billion on a monthly basis between July and the end of the year.

Contact our company formation agents in Vietnam for their services.

You can also rely on our local advisors if you want a virtual office in Vietnam. They can guide you about the available virtual office packages.