Vietnam is a country that provides a suitable legal framework for those who want to invest here – foreign investors can benefit from the same rights as the local businessmen. Foreign businessmen can register any of the legal entities that are prescribed by the Vietnamese Commercial Code, which have similar traits as the ones that one can find in the Western world.

The commercial legislation that is currently available in Vietnam can provide two main categories of companies, that can be comprised in the following categories: forms of enterprises and forms of direct investments. Our team of specialists in company formation in Vietnam can offer more details on the company types that one can register here, and investors can also rely on the expertise of our team for the registration procedure applicable to local commercial entities.

The limited liability company in Vietnam

Setting up a limited liability company in Vietnam is the most common way to start a business in this country, as this company type accounts for most of the company registrations completed here, just as it is the case in other countries.

| Quick Facts | |

|---|---|

| Types of entities available for registration | Non-corporate and corporate entities. |

|

Requirements to set up a Vietnamese sole trader |

The sole trader can be created by a single person who has a specific profession or knows a trade/craft. |

|

Types of partnerships |

General and limited partnerships are available in Vietnam. |

| Types of limited liability companies | Private limited liability companies and joint stock companies. |

| Types of private limited liability companies |

– Single-member company, – the private company with two or more shareholders. |

| Most popular types of companies in Vietnam |

The private limited liability company. |

| Legal forms available for foreign companies |

– Branch office, – representative office, – subsidiary. |

| Most employed legal form by foreign investors |

The private entity with one member or more, depending on the number of shareholders. |

| Full foreign ownership availability (YES/NO) |

Yes, full foreign ownership is available in Vietnam. |

| Special requirements for foreign shareholder (if any) | Yes, foreign shareholders are required to apply for an investment license prior to opening a company. |

| Simplest type of company to incorporate |

The private limited liability company. |

| Possibility for foreign companies to act as shareholders (YES/NO) |

Yes. |

| Requirement of specific share capital |

Yes, however, it is determined based on the industry the company will operate in. |

| Average timeframe to register a company |

One month – one month and a half. |

| Company formation services available (YES/NO) | Yes, we are at your service if you want to open a company in Vietnam. |

This business form can be: a single-member limited liability company and a multiple-member limited liability company. Foreign investors who want to open a company in Vietnam as a limited liability company should know that they are not required to submit any capital during the incorporation formalities.

The Vietnamese joint stock company

The joint stock company is the correspondent of the public companies in European countries, however it does not imply a minimum share capital, just like in the case of the limited liability company. The Vietnamese joint stock company must have its capital divided into shares and at least 3 shareholders.

The partnership and the private enterprise in Vietnam

These represent other options available for investors interested in company formation in Vietnam. While the partnership must have at least two members who will act as partners in the company, the private enterprise is similar to the sole trader in other states. Our Vietnam company registration agents can advise and provide legal representation on the registration of any of the company types presented here.

How can one register a sole trader in Vietnam?

The sole trader is a type of entity that is prescribed by the commercial law for the purpose of creating a legal environment through which individuals in Vietnam can carry a small business activity in their own name. The main advantage of this structure is that it has few reporting requirements and that the founder, who must always be a natural person, can take the entire profit of the company for himself or herself.

However, there are certain disadvantages as well, that can be presented by our team of consultants in company registration in Vietnam. For instance, the investor is not allowed to associate with another partner in this type of business, and this can become a disadvantage for persons who are not sure how to make better investments.

The procedure for opening a company in Vietnam as a sole trader is established under the Law on Enterprise 2020, which became applicable starting with 1st of January 2021. The investor has to submit a set of documents and when the file is completed, it can be sent via the online portal of the registration institutions or it can be presented in person, at the office where the investor has his or her residence.

As a general rule, one can expect to receive the registration certificate of the sole trader in a period of 6 working days since the file was submitted. However, this can be influenced on whether the investor has completed, as required by the law, all the documents or if the file contains all the required papers.

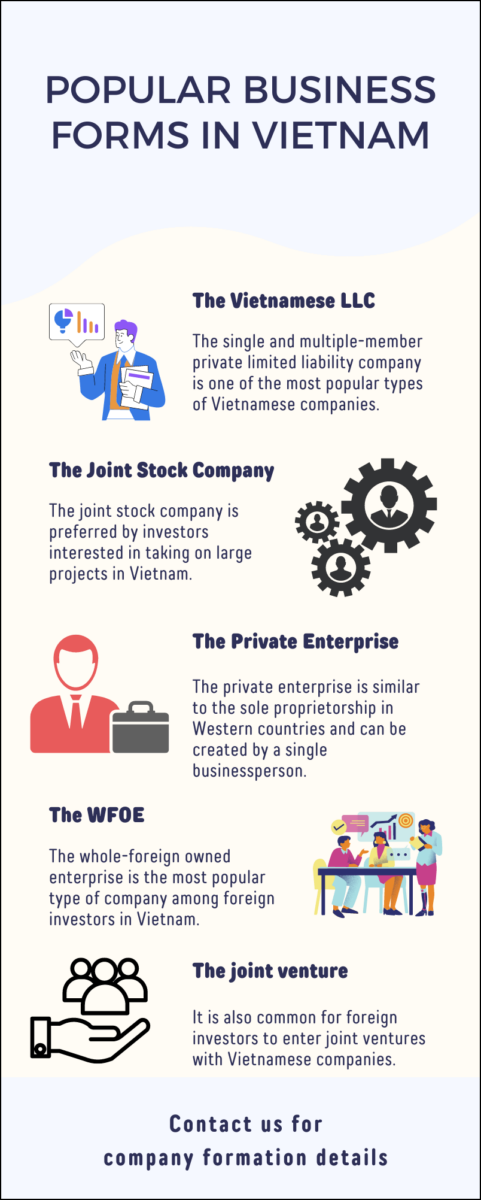

Here is an infographic on the main business forms available in Vietnam:

Forms of direct investments in Vietnam

With regards to companies that can be set up here with foreign capital, the Enterprise Law, applicable starting with 2015, prescribes several types of legal entities, as follows: the joint venture, the wholly foreign-owned enterprise, the business cooperation contract, the public-private partnership and the Build-Operate-Transfer (BOT), the Build-Transfer (BT), the Build-Transfer-Operate (BTO), the Build-Operate (BO) agreements.

We are also at the service of persons interested in applying for trademark registration in Vietnam.

How can foreign investors register a foreign-owned enterprise in Vietnam?

The foreign-owned enterprise in Vietnam provides as a major advantage the fact that foreign investors are allowed to register the company with full foreign ownership, as the name suggests. Below, our team has prepared a short presentation on the main steps you should take for company incorporation in Vietnam for this company type:

- investors will have to prepare a file for an Investment Registration Certificate;

- the document has to contain a written request presenting the investment project that will be carried out through the company;

- the company’s founders can be either natural persons, either corporate structures and for each situation, personal identity documents or corporate certificates will need to be added to the file;

- then, the file should contain very detailed information regarding the capital investment, the duration of the project, its location, the estimated number of employees and the objectives investors want to achieve;

- the file should also contain documents that show that the respective investment project can be entitled to receiving various investment incentives.

We are at the service of foreign investors who want to open a bank account in Vietnam.

What is the data on companies registered in Vietnam?

When starting the process of company formation in Vietnam, investors will have to register with the local institutions, for the issuance of the registration certificate and for taxation purposes. Any modifications of the data registered during the incorporation of the company have to be announced so that the local authorities can be updated on the overall situation of the business environment.

Thus, local institutions are aware of all new company registrations, modifications, but they are also informed if a share of the legal entities registered here has stopped business operations, as companies are also obligated to notify on this. Liquidations, bankruptcy and winding up are also registered with the local authorities. Below, we present data on the current situation of businesses registered in Vietnam, as revealed by the General Statistics Office:

- in the first 6 months of 2021, a total number of 70,200 companies withdraw from the local business environment;

- however, in the first 6 months of 2021, a total of 93,200 companies were incorporated in Vietnam or re-started their business activities;

- in June 2021, the procedure for company formation in Vietnam was completed for 11,314 businesses;

- in June 2021, there were 5,238 companies that were involved in the dissolution procedure;

- the total number of employees in June 2021 stood at 71,881 persons;

- in the same month, 4,867 companies re-started their business activities in Vietnam.

Here is also a video on this subject:

Foreign investors also have the option of opening a branch office in Vietnam or representative offices. Our team can provide an in-depth presentation on all the legal entities that can be registered under the local law to foreigners who want to open a company in Vietnam. Please feel free to contact us if you need assistance in registering a company in Vietnam.