A Vietnam subsidiary company is an independent structure. Our company formation consultants in Vietnam can explain the features of subsidiaries registered in this country. They will also practically assist you to open a subsidiary in Vietnam.

In case you want to set up a subsidiary in another Asian country, for example in Singapore, we recommend our local partners – OpenCompanySingapore.com.

Requirements to open a subsidiary in Vietnam

The Vietnamese law is very permissive with foreign companies seeking to operate on the local market through subsidiary companies. This is because the government is very keen on attracting new foreign investors.

The requirements for creating a subsidiary in Vietnam in 2024 are:

- in terms of shareholding, the subsidiary may be solely owned by the foreign company, unlike in other countries where a local partner may be required;

- in terms of management, the subsidiary in Vietnam must appoint at least one director who can be a foreign citizen, but who needs to obtain a work visa and have at least one year of experience in a management role;

- in terms of capital, the minimum amount of money accepted is 10,000 USD.

Also, the Vietnam subsidiary must have a registered address in this country. Our Vietnam company registration specialists can explain each point of the requisites mentioned above.

| Quick Facts | |

|---|---|

| Applicable legislation (home country/foreign country) | Vietnam Enterprise Law of 2020 |

|

Best Used For |

All types of activities related to commerce, e-commerce, wholesale, retail, import-export, etc. |

|

Minimum share capital (YES/NO) |

There is no minimum capital imposed for setting up a subsidiary in Vietnam. |

| Time frame for the incorporation (approx.) | About 30 days, however, the procedure also depends on the industry the subsidiary will operate. |

| Documents to be filed by parent company |

– bylaws of the new company, – details of the parent company, information about the director(s), – application form |

| Management (Local/Foreign) |

The management can be local or foreign. |

| Legal representative required (YES/NO) |

Yes, a Vietnamese subsidiary must have at least one resident officer who can be a director. |

| Local bank account (YES/NO) |

Yes |

| Independence from the parent company |

The subsidiary is an independent company in relation to the parent firm. |

| Liability of the parent company | The parent company is exempt from any liability in connection to its subsidiaries in Vietnam. |

| Corporate tax rate |

20% on the entire income |

| Annual accounts filing requirements |

Companies must file annual accounts and financial statements in accordance with Vietnam’s Accounting Standards. |

| Possibility of hiring local staff (YES/NO) |

Yes, it is possible to hire local employees. |

| Travel requirements for incorporating branch/subsidiary (YES/NO) |

No, there is no need to travel to Vietnam to complete the subsidiary registration procedure. |

| Double tax treaty access (YES/NO) | Yes, Vietnam has a network of more than 80 double tax agreements. |

In the process of setting up a subsidiary in Vietnam, it is very important to have a registered address, which you may obtain by opting for a virtual office.

You are welcome to interact with our consultants if you want a virtual office for your subsidiary.

Our experts will explain to you the different virtual office packages and also guide you to the appropriate package that suits your business needs.

There are several reasons to consider a virtual office in Vietnam as an alternative to leasing or purchasing traditional office space, especially for remote or home-based company owners.

You can make a better-informed choice for your company if you understand the advantages of a virtual office. Our company incorporation experts can give you more details on this matter.

We are also at the service of entrepreneurs who want to open bank accounts in Vietnam.

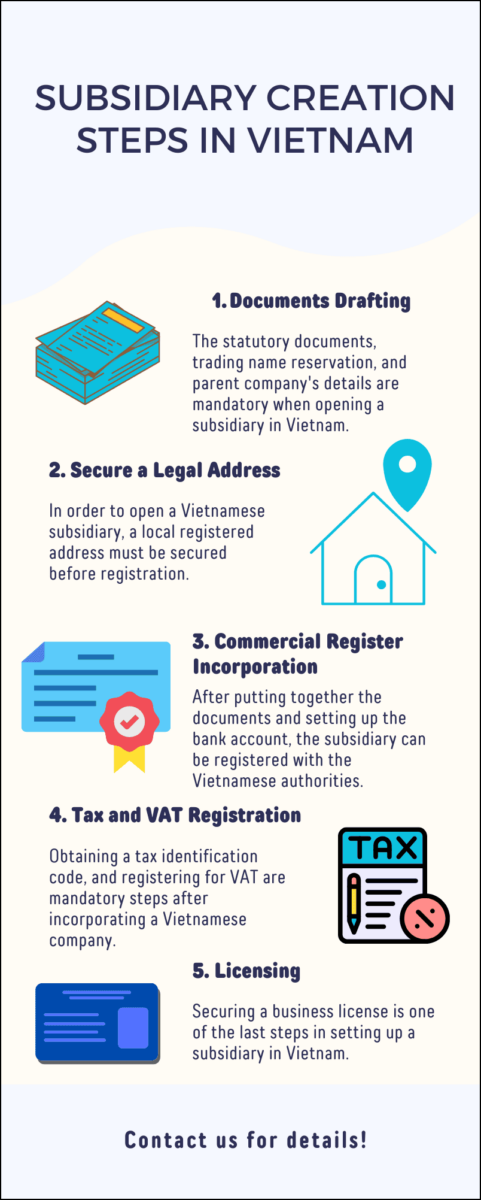

We also have an infographic on how to open a subsidiary company:

Registering the subsidiary company in Vietnam in 2024

Once all the requirements are complied with, the parent company starts the incorporation procedure of the Vietnam subsidiary. This procedure implies:

- preparing the Articles of Association and the bylaws of the company;

- opening the corporate bank account;

- obtaining a foreign investment certificate.

The documents mentioned above, including a bank deposit slip, must be filed with the Business Registrar in Vietnam. It should be noted that the share capital must be deposited within 12 months from the registration of the subsidiary.

In addition to establishing a subsidiary in Vietnam in 2024, the branch office is a well-known business structure in this region. Through such an office, a foreign company can run its operations in Vietnam and carry out the same duties as it does in the home country. Our company incorporation agents can help you open a branch office in Vietnam.

You can also watch our video on how to set up a subsidiary in Vietnam:

Trademark registration services for subsidiaries in Vietnam

Besides registering a subsidiary, you also need to protect the company’s rights from any infringement. So, considering Vietnam is a “first-to-file” nation, it is necessary to register a trademark to receive protection and property rights for it.

On the other hand, well-known trademarks which extend their activities through subsidiaries in Vietnam, can be protected in rare circumstances even if they have not yet applied for trademark registration.

Patents and trademarks must be registered with Vietnam’s National Office of Intellectual Property (NOIP).

Our company formation agents can definitely help you register your trademark in Vietnam.

How long does it take to register a subsidiary in Vietnam?

Vietnam’s subsidiary registration process takes a month to complete (or 30 business days). The length of time required for registration, however, will vary based on the type of business and the sector in which it operates. In such circumstances, corporations are required to submit sublicense applications, extending the registration time.

If you are planning to open a subsidiary in Vietnam, you are welcome to get in touch with our agents. They can provide you with practical assistance to help you extend your business in Vietnam.

Conditions for opening a subsidiary in Vietnam

The rules regulating LLCs in Vietnam are indeed complicated. There are many regulations to meet, and it may be a time-consuming and costly procedure.

Though there will be no minimum capital requirement, you will need to recruit investors to form an LLC and then establish your subsidiary.

You can pick from a single investor or a group of investors with a minimum of two shareholders and a maximum of 50 members.

The corporation can function as a wholly foreign-owned entity or as a joint venture with at least one local partner.

A members’ council comprising a chairman, a director or general director, and a controller should be part of your company’s management structure.

If your LLC has more than 11 members, you will also need a board of supervisors, though the members’ council, which comprises all capital-contributing members, is in charge of making decisions.

If you want to set up a Vietnamese subsidiary company, you can get assistance from our experts. Their detailed assistance regarding company formation in Vietnam can help you.

You should be aware that everyone who wants to start a business in Vietnam must follow the regulations. The laws governing investments require investors to make choices on the many facets of launching a business in Vietnam.

We suggest choosing a limited liability corporation among the variety of choices accessible to a potential investor wishing to expand a business in Vietnam. This is primarily due to its simple layout.

The main benefit of establishing an LLC is the exclusion of equity investors from liability for debts and losses above their share of contributed capital.

If you want to open a subsidiary, get in touch with our Vietnamese company incorporation agents.

Incorporation costs for a subsidiary in Vietnam

The typical price to set up a subsidiary in Vietnam would be at least VND 9,000,000.00, or USD 410.00. The price covers:

- legal document authentication and photocopies;

- registering the subsidiary with the Trade Register in Vietnam;

- presentation of foreign subsidiary’s content in Vietnam;

- the price of a seal;

- the lawyer’s fees (if any).

Foreign investors are required to provide charter capital in addition to the costs associated with establishing a subsidiary in Vietnam.

The price of incorporation may change based on where the subsidiary is located. If you need any additional assistance in this regard, you can get help from our company incorporation consultants in Vietnam.

Advantages of setting up a subsidiary in Vietnam in 2024

The most significant advantage of setting up a Vietnam subsidiary is that you may immediately begin working in the country.

Another advantage is the fact that the parent and the subsidiary can operate independently of one another. The parent firm will not be responsible for any liabilities incurred by the subsidiary. Furthermore, the subsidiary in Vietnam can operate autonomously and maintain its own corporate culture in 2024.

With our incorporation services, our business formation professionals can provide even more benefits. You will not have to go through the long subsidiary establishment process if you get in touch with our consultants.

In addition to this, online incorporation is another service provided by our Vietnamese business formation agencies.

You are welcome to speak with one of our Vietnam-based company formation advisers if you need assistance with online business incorporation.

They can advise you on the company structures that are accessible online and help you choose the one that better matches your demands.

Why do you need the help of our incorporation agents?

Vietnam has one of the fastest-growing economies in the world, making it a hub for establishing companies and subsidiaries.

For multinational corporations, starting a business or establishing a subsidiary in Vietnam is a huge opportunity. It allows them to create new connections, recruit new team members, and expand the organization’s horizons.

The establishment of a Vietnam subsidiary in 2024, however, can take weeks or even months. It is highly important to take into account the business variables that support the business objective and the jurisdiction in which to register a subsidiary.

Therefore, it is crucial to take into account Vietnam’s stringent regulations for foreign investment and comprehend Vietnam’s subsidiary legislation. Your business may be impacted by different regulations, and prices, in various towns and areas.

Setting up a subsidiary in Vietnam will be effective with careful planning.

The non-resident director of the subsidiary should travel to and from Vietnam if necessary to ensure all applicable laws are taken into account, open up a firm, process payroll, and hire staff.

Establishing a budget early on is essential because setting up a subsidiary in Vietnam can frequently be expensive when all these things are taken into account.

If you need all these matters to be taken care of by the experts, please consult with company formation agents in Vietnam. They can offer you the list of services they provide in this country and how their services are effective.

Vietnamese subsidiary tax incentives for foreigners

If overseas businessmen intend to incorporate a subsidiary in Vietnam, he/she can benefit from the following tax incentives:

- The incentives are provided to the subsidiaries which are regulating in the industries linked to information technology, high technology, health care, sport and culture, and environmental protection;

- Subsidiaries incorporated by the foreigners in Vietnam enjoy import tax exemption on raw materials for projects in the areas that are given special encouragement;

- Some subsidiaries are also eligible for various import tax exemptions, such as those for imported machinery and equipment;

- Entitlement to longer tax holidays, including a CIT exemption of up to four years and a CIT reduction of 50%.

You are welcome to interact with our agents if you are planning to establish a subsidiary in Vietnam. They can provide you with comprehensive information about the tax incentives available in this country for foreigners.

Taxation of subsidiaries in Vietnam

If you want to set up a subsidiary in Vietnam, it is crucial to comply with the rules and regulations regarding taxation. You can find general information about corporate taxation here presented by our company formation agents in Vietnam. For any further assistance, you can get in touch with our company incorporation consultants.

The corporate income tax (CIT) applies to all income earned in Vietnam, regardless of whether a foreign company has a Vietnam-based subsidiary or if that business is established as a new company. If accompanied by proper legitimate invoices and paperwork, foreign firms can deduct most expenditures paid for production and commercial operations, through CIT computation. Please find below the main taxes applicable in Vietnam:

- The ordinary corporate income tax (CIT) rate in Vietnam is 20%;

- Dividends given to corporate shareholders by a Vietnamese firm will be tax-free;

- Individual stockholders will be subject to a 5% withholding tax;

- Residents pay a progressive personal income tax, with rates ranging from 5% to 35%;

- Non-resident people, on the other hand, are subject to a 20% flat tax rate.

Foreign investments in Vietnam in 2024

It is anticipated that foreign direct investment (FDI) would continue to be a major force behind economic growth in 2024. In 2023, there was a notable 32% growth in foreign investment inflows into Vietnam, amounting to approximately USD 36.62 billion.

Vietnam continues to be a favored location for foreign direct investment, particularly in light of the China+1 approach. Regarding Vietnam as a platform for supply chain diversification, both Chinese investors and Western multinational firms have high hopes.

The Macroeconomic Research Office kept its growth prediction for the ASEAN+3 region (ASEAN plus China, Japan, and South Korea) at 4.5% through 2024. Growth is anticipated to be driven by robust domestic demand, moderate inflation, and continuous trade improvements, even in the face of uncertainty surrounding the global outlook.

Contact our company incorporation specialists if you want to open a subsidiary in Vietnam. Our experts will provide you with a detailed presentation regarding setting up a subsidiary in Vietnam.

Furthermore, you can also interact with our company formation consultants if you want to open a company in Vietnam besides a subsidiary.

Our experts will provide you with practical assistance throughout the process of company formation in Vietnam.